The building blocks behind your success.

*Blox Funding Offers Business Purpose Loans Only.

Our vision

At Blox Funding, we drive your success through innovative lending and lasting partnerships.

We are dedicated to collaborating with our clients and referral partners, delivering transparency and swift service to build a long term partnership.

One loan at a time, we build your path to success together.

-

No Income Verification

No personal income verification required; underwritten using DSCR instead of personal DTI. We take 100% to 120% of the subject rental to qualify.

-

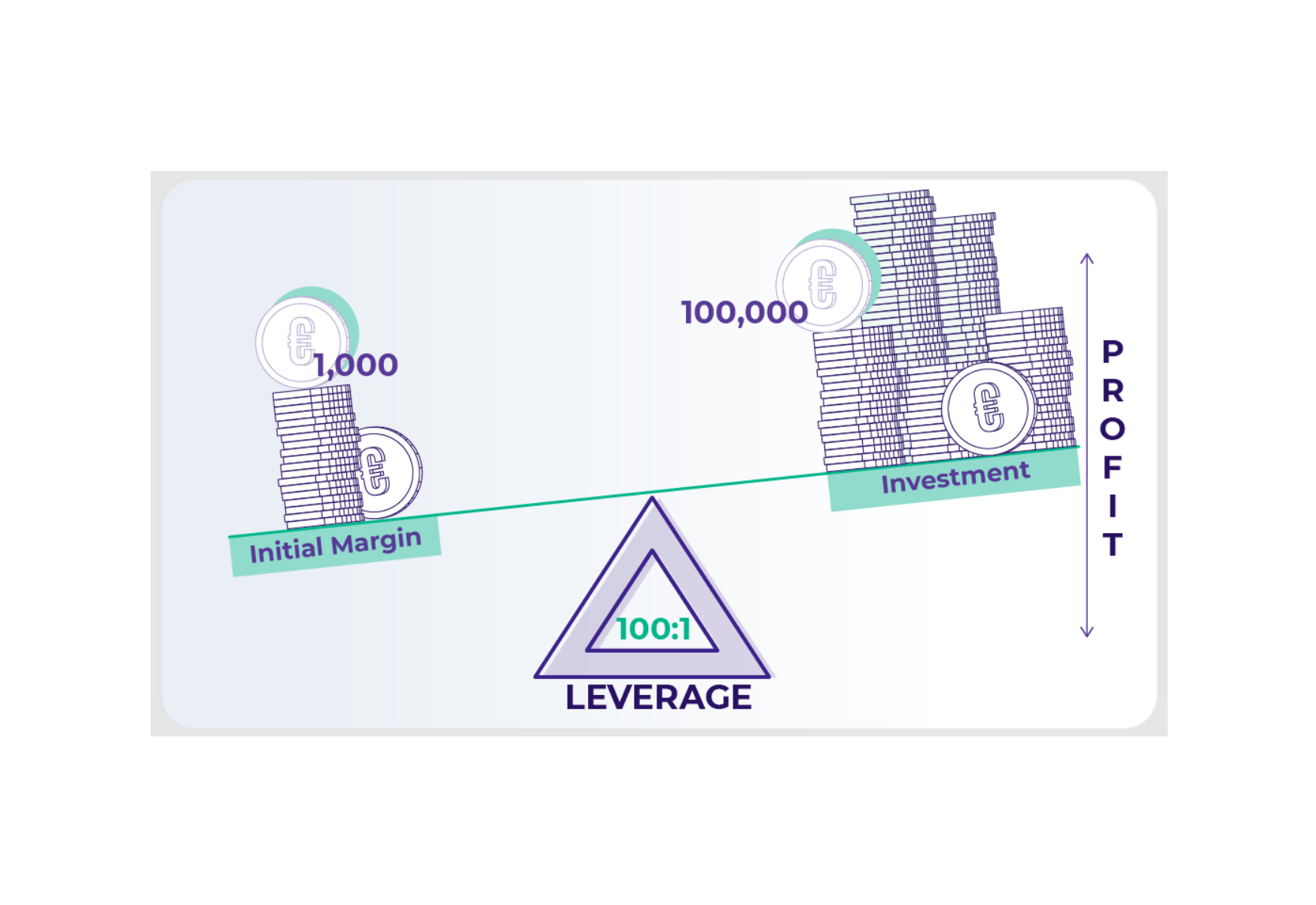

High LTV and LTC

Seeking maximum leverage? Our loan-to-value ratio of up to 80% and loan-to-cost ratio of up to 90% will minimize your down payment, optimizing your financing.

-

Competitive Rates

We partner with you to secure your deals, offering market-leading rates to keep financing costs low and drive your success.

-

Flexible Options

Close in personal name or entity with fully amortized or interest-only options, featuring a flexible prepayment penalty structure.

Our Programs

-

D S C R

Qualify based on the subject property’s cash flow, not personal debt-to-income. We use 100% to 120% of the rental income for calculation.

-

Bank Statement

Ideal for self-employed borrowers. Use 12–24 months of bank statements to prove income.

-

P&L Only

Qualify based solely on accountant-prepared profit & loss statements without any business or personal bank statements.

-

1099 Only

Qualification based on 90% of your most recent year 1099 gross income. No tax returns required, simplifying the process for fast and flexible financing.

-

Asset Depletion / Utilization

Using liquid assets as income for loan qualification. No tax returns needed.

-

ITIN / Foreign National

Loans available for non-residents with Individual Taxpayer Identification Number and foreign national borrowers.

-

Fix & Flip

Quick funding for purchase and renovation; draw schedules for rehab costs.

-

Bridge

Short-term financing to bridge the gap between transactions; fast approvals and funding.

-

Ground-Up Construction

Finance new construction projects with flexible terms and interest-only payments during the build.

Contact Us

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!